Payday Loans: Smart Borrowing Options

Installation Loans Explained: Essential Info for Debtors Looking For Financial Solutions

Installment lendings offer an organized strategy to loaning, providing debtors with a round figure that is repaid in repaired installations with time. These lendings can be helpful for handling substantial expenses, yet they additionally feature potential threats. Recognizing just how they function and the implications of taking one on is important for any person considering this economic option. As borrowers evaluate their choices, several factors require mindful factor to consider.

What Are Installment Loans?

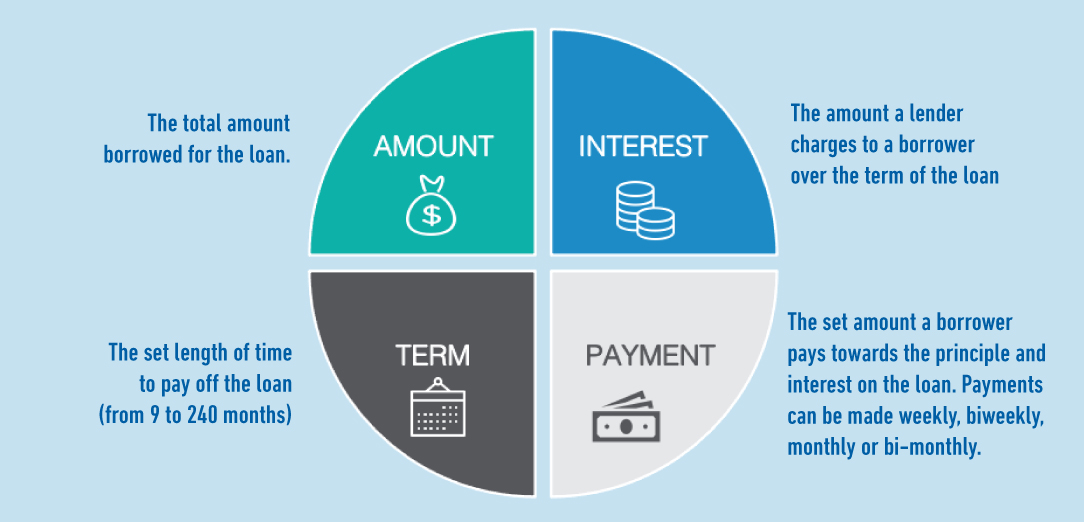

Installment fundings are a kind of loaning plan where a consumer obtains a round figure of money and consents to settle it in repaired, scheduled repayments over a specific duration. These financings are frequently made use of for different purposes, consisting of buying a lorry, funding home improvements, or combining financial obligation. Consumers commonly gain from foreseeable repayment amounts, making it simpler to budget plan.

The terms of installation finances can vary substantially, consisting of the rate of interest, repayment period, and any kind of involved charges. Usually, these financings are protected or unsecured, with safe car loans calling for security to mitigate lender risk. Installation loans can be accessed with traditional banks, credit history unions, or on the internet loan providers, each providing different terms and requirements.

Because of their organized repayment strategy, installation fundings can help debtors develop or enhance their credit report, provided they stick to the repayment routine. Recognizing the essential elements of installment finances is essential for notified loaning choices.

Just How Do Installment Car Loans Job?

Borrowers start the process of obtaining an installment finance by requesting a certain quantity of money, which is then examined by the lender based upon creditworthiness and monetary background. Once authorized, the lender disburses the funding total up to the customer, that concurs to a settlement schedule. This timetable commonly involves fixed monthly settlements over a predetermined duration, which can vary from a number of months to several years.

The payments contain both primary and rate of interest, permitting customers to progressively minimize their financial debt. Interest prices may differ depending upon factors such as credit rating and lending term. Debtors have to adhere to the repayment plan, as missing repayments can cause charges and adversely influence their credit rating. In addition, lenders may require collateral for bigger lendings, providing safety versus possible defaults. In general, recognizing the technicians of installation loans is essential for borrowers seeking economic solutions.

Benefits of Getting an Installment Funding

Taking out an installation car loan offers a number of advantages that can be useful for those in demand of financial aid. One crucial advantage is the foreseeable payment structure, which allows debtors to intend their spending plans effectively. Unlike revolving credit score, installment finances have actually taken care of monthly repayments, making it simpler to handle finances. Furthermore, these fundings usually include reduced rate of interest compared to debt cards, which can result in considerable savings in time.

An additional benefit is the potential to boost credit report. Prompt settlements on installment financings can enhance a debtor's credit scores account, opening up doors to far better financial opportunities in the future. Installment finances can supply access to bigger sums of cash, making it possible for people to deal with significant expenses.

Last but not least, the application process for installment finances is commonly straightforward, typically requiring minimal documents, which can bring about quicker authorization and financing. Installment Loans. These elements make installment finances a sensible alternative for numerous borrowers seeking economic options

Typical Utilizes for Installation Loans

Installation loans serve different practical objectives for consumers. Usual applications include financing home enhancements and aiding with financial debt consolidation. These fundings supply a structured repayment strategy, making them see page appealing for managing substantial costs.

Home Improvements Financing

When property owners choose to enhance their living spaces, financing options like installment fundings commonly come to be a viable solution. These lendings provide a structured way to money numerous home renovation jobs, such as cooking area remodels, bathroom upgrades, or energy-efficient setups. By supplying fixed monthly settlements and details payment terms, installment car loans allow homeowners to spending plan successfully and handle their funds without significant stress. Additionally, these lendings can cover both small restorations and larger building tasks, dealing with an array of demands. House owners can utilize the equity in their residential or commercial properties or go with unsecured finances, relying on their monetary circumstance. Generally, installment car loans act as a functional resource for individuals looking to buy their homes and boost their quality of life.

Financial Obligation Consolidation Support

Homeowners often face various financial obstacles, and one common issue is managing multiple financial debts. For several, financial obligation consolidation making use of installation finances presents an click for more info effective service. This technique allows consumers to combine several high-interest financial debts right into a single, manageable settlement with a set interest price and term. By settling debts, home owners can improve their financial resources, decrease monthly settlements, and possibly lower their general interest costs. Furthermore, installment loans usually offer predictable settlement timetables, making budgeting much easier. This financial approach not just minimizes stress however likewise helps boost credit rating by lowering credit rating utilization proportions. Generally, debt combination support via installation loans can give property owners with a more clear course to economic security and satisfaction.

Prospective Disadvantages of Installation Loans

While installment financings can be helpful, they also come with a few noteworthy drawbacks. High rate of interest might bring about increased overall prices, and the dealt with payment schedule can develop economic pressure. Furthermore, there is a danger of overborrowing, which can worsen debt issues for consumers.

High Rate Of Interest

Although installment loans can offer quick access to funds, they frequently include high rates of interest that can greatly enhance the total price of loaning. Consumers may find themselves paying considerably greater than the primary amount over the period of the funding. These high rates can be credited to numerous aspects, including the debtor's creditworthiness, the funding amount, and the lending institution's policies. While some debtors may prioritize instant economic demands, they should meticulously assess the lasting effects of greater passion payments. An enhanced economic worry may lead to difficulties in taking care of future costs. It is necessary for possible customers to thoroughly assess the rate of interest rates associated with installation fundings before making a choice.

Danger of Overborrowing

High rates of interest can lead borrowers to handle more financial obligation than they can take care of, causing the risk of overborrowing. This sensation occurs when people, inspired by prompt monetary requirements, safe bigger financing quantities than needed, typically without completely considering their repayment capability. Therefore, they might discover themselves trapped in a cycle of financial obligation, having a hard time to satisfy regular monthly obligations while accruing extra interest. Overborrowing can additionally cause reduced credit scores, making future borrowing more difficult and costly. Additionally, consumers may experience increased tension and anxiousness, impacting their general economic well-being. It is important for consumers to analyze their monetary scenarios thoroughly and stay clear of the temptation to take on too much financial debt, guaranteeing they remain within their means.

Fixed Settlement Set Up

A fixed repayment routine is a defining quality of installment finances, supplying consumers a structured structure for settlement. While this predictability can be beneficial, it likewise presents prospective disadvantages. Debtors are usually locked right into an inflexible layaway plan, which might not suit unanticipated monetary changes, like task loss or clinical emergencies. This rigidness can lead to struggles in meeting settlement commitments, potentially resulting in late fees or damages to credit report. Furthermore, consumers may discover themselves paying more in passion if they desire to repay the loan early, as numerous lenders enforce early repayment penalties. While a fixed payment schedule can offer clarity, it may likewise restrict monetary flexibility and flexibility for debtors encountering unforeseen circumstances.

Tips for Picking the Right Installation Funding

Frequently Asked Questions

What Credit History Rating Is Needed for an Installation Funding?

A credit report score of 580 or higher is generally needed for an installment car loan. Some loan providers might offer options for those with lower scores, frequently resulting in greater interest prices and less favorable terms.

Can I Repay My Installment Lending Early?

Yes, customers can typically settle their installment lendings early. They must examine their lending agreement for any prepayment charges or fees that might use, as these can influence the overall financial savings from early settlement.

Are There Charges Connected With Installation Loans?

Yes, there can be costs connected with installation loans, including origination fees, late payment fees, and prepayment penalties. Customers need to thoroughly evaluate financing agreements to comprehend all potential expenses before dedicating to a funding.

Exactly how Long Does It Take to Get Approved?

Authorization for installment loans typically takes anywhere from a couple of mins to a number of days, depending on the lender's policies and the efficiency of the applicant's documents. Quick online applications often speed up the procedure significantly.

Will Taking an Installation Funding Impact My Credit Report?

Taking an installation lending can affect a credit rating both favorably and adversely (Fast Cash). Prompt settlements might enhance credit reliability, while missed payments can lead to a decline, reflecting the significance of responsible borrowing and settlement routines

Installation loans use an organized strategy to loaning, offering borrowers with a lump amount that is paid off in fixed installations over time. Typically, these finances are safeguarded or unsecured, with guaranteed loans calling for security to minimize lender danger. Due to their structured payment strategy, installation financings can assist debtors develop or boost their debt rating, supplied they stick to the settlement routine. Borrowers initiate the procedure of getting an installation loan by applying for a particular quantity of cash, which is then evaluated by the loan provider based on credit reliability and economic background. Timely payments on installment loans can enhance a customer's credit rating profile, opening doors to much better financial possibilities in the future.